Beyond Traditional Insurance: Go Cheap with SR-22 Coverage

Its no secret that traditional insurance coverage can be expensive. But its possible to save money by getting SR-22 coverage instead. SR-22 insurance provides a lower-cost alternative that still provides the security and peace of mind you need.

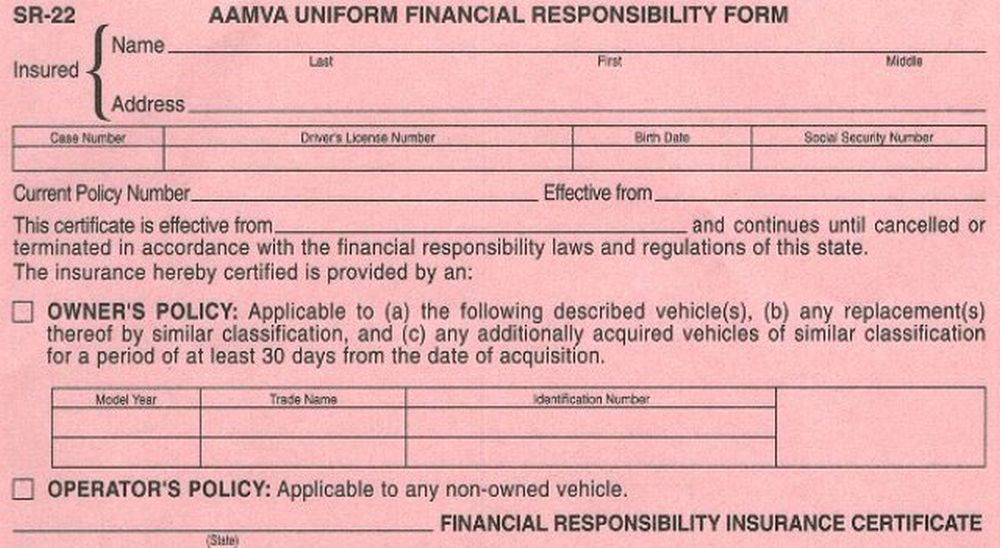

What is SR-22 insurance? Generally, its a type of financing youll need to obtain from your insurance company if youve been involved in certain activities or convictions. By getting SR-22 coverage, youre showing insurance companies and the state youre taking responsibility and are financially prepared to handle situations if they arise. Its also known as high-risk insurance but the benefits can be well worth it.

First and foremost, SR-22 coverage can offer you a more affordable way to secure the insurance policy you need. If youre convicted of any DUI or DWI charges, youll often face an expensive insurance premium. SR-22 coverage can make your insurance more affordable and give you the safety net you need in case of an accident.

Whats more, an SR-22 filing provides you with an extra layer of protection. With this type of filing, the insurance company promises the state that youre actively insured and properly covered. This means if you keep your policy in good standing, your driving record will stay clean.

Above all, SR-22 coverage helps you stay legal and in compliance. In some states, you may be required to file an SR-22 after certain convictions. If you do, its important to know that the filing typically lasts for a certain period of time before its no longer active. That means it is in your interest to secure the right type of coverage quickly and be able to show that you are insured and covered.

Of course, there are other benefits with SR-22 coverage. For example, while the coverage itself is typically inexpensive, you can also add additional coverages to it such as collision and comprehensive that can help you further protect yourself and your assets. Additionally, the SR-22 filing usually offers up to 25/50/25 coverage, which is about 39 percent higher than the minimum liability typically found in a streamlined, affordable insurance policy.

Plus, getting SR-22 coverage is easier than many people may realize. Talk to your insurance agent, who can help you find the right coverage at the right price for your specific situation.

To add to that, depending on the state you live in, you may have other options. Some states, for example, may require an SR-22 filing with either a non-owner or owner policy. Talk to your insurance company to see which one is best for you.

Also, its critical to remember that SR-22 insurance isnt a policy type; instead, its just a filing that can used with certain policies. So its essential to make sure you have the right type of coverage to protect yourself.

Another point is, SR-22 coverage isnt necessarily only for high-risk drivers. Even people who havent been convicted of anything can benefit from SR-22 coverage. For instance, having a cheaper policy can help you manage your costs in the event that you are involved in an accident.

Ultimately, SR-22 coverage offers excellent benefits and can be more affordable than a traditional car insurance policy. The key is to do your research and make sure youre getting the coverage, protection and peace of mind you need and deserve.

In addition, many important pieces of information surround SR-22 coverage. For example, a company that provides SR-22 insurance must be approved by the state where the driver is living. You can always ask your insurance company to help you check if your provider is approved. Another thing to be aware of is that if you move to a different state after getting an SR-22 policy, youll need to transfer your coverage.

It is also important to follow any necessary steps to keep your policy active and valid. Working with your insurance company you can stay on top of any dues, payments, or other actions needed to keep your SR-22 policy in good standing. You should also bear in mind that there might be various forms of SR-22 certification that could affect your policy; for instance, theres the owners certificate, the non-owners certificate, and a certificate for a drivers convicted of an out-of-state offense.

Apart from that, you can look for discounts that could affect your policy and lower its price. This could be simply by using the same insurance provider across multiple vehicles and drivers, or certain incentives and promotions that the company might give you. Doing so could lower your insurance premium and give you a better deal on your SR-22 policy.

On top of that, its good practice to shop around and compare rates from different providers. Even if you have enough affordable options for an SR-22 policy, comparing rates from multiple companies can give you a better chance of finding the best deal. Its important to remember that its not just about getting the lowest price but also the best coverage for your needs.

Finally, your states Department of Motor Vehicles can offer you information and guidance if you seek to purchase SR-22 insurance. They can provide you with the necessary forms youll need to obtain the coverage and answer any questions or concerns you may have.

Although traditional insurance can be pricey, SR-22 coverage provides an alternative with greater affordability and protection. It can save you money, keep you in compliance, and provide you with the peace of mind you want and deserve. Have you considered getting an SR-22 insurance policy?

To expand further, you can consider the type of car you drive. Cars that are luxury vehicles or sports cars are more costly to insure, so getting SR-22 coverage could be a better choice if you cant afford to insure those more expensive models. You can also find out if your state has any special laws that you should be aware of when it comes to getting SR-22 coverage.

Whats more, it is also possible to save money on the coverage itself by adding deductibles and raising your liability limits. A deductible is the amount of money youll have to pay out of pocket in case something happens, such as an accident. Increasing your liability limits could also lower your premiums, as it adds another layer of protection.

Additionally, its also a good idea to keep track of your driving record. Your driving record can impact the cost of your car insurance policy so maintaining a clean record is beneficial. You can also be more proactive and look for discounts such as low mileage discounts or multi car discounts that could lower your premiums even further.

Furthermore, you should always be sure to read your policy thoroughly and make sure you understand what is covered and what isnt. SR-22 policies can vary greatly from state to state and its important to make sure you have the coverage you need.

Finally, its also possible to find additional help if youre having trouble getting coverage. Many states offer programs that guarantee financial coverage for drivers who are deemed to be a greater risk. If youre considering getting SR-22 coverage, this could be an option.

Taking all of this into consideration, its easy to see why so many drivers are turning to SR-22 coverage. Although traditional coverage can be expensive, getting SR-22 insurance can be a great way to save money while still getting the protection and peace of mind you deserve. But do you know what it really means to have SR-22 coverage, and how it could be beneficial to you?